tax preparation fees 2020 deduction

Theres a reason why you couldnt input it on the form. You could go the diy route with tax preparation software or take the less stressful route and work with a cpa firm in raleigh.

Small Business Tax Deductions For 2022 Llc S Corp Write Offs

Before you gulp you can take some comfort in knowing that this generally includes both your state and federal returns.

. Deductions can reduce the amount of your income before you calculate the tax you owe. You can deduct the turbo tax cost or any tax preparation fees you actually paid in on your. In order to meet this you have to fit the folowing criteria.

Deducting medical expenses in 2020. Deducting Business Tax Preparation Fees. Medical expenses are tax deductible but only to the extent by which they exceed 10 of the taxpayers adjusted gross income.

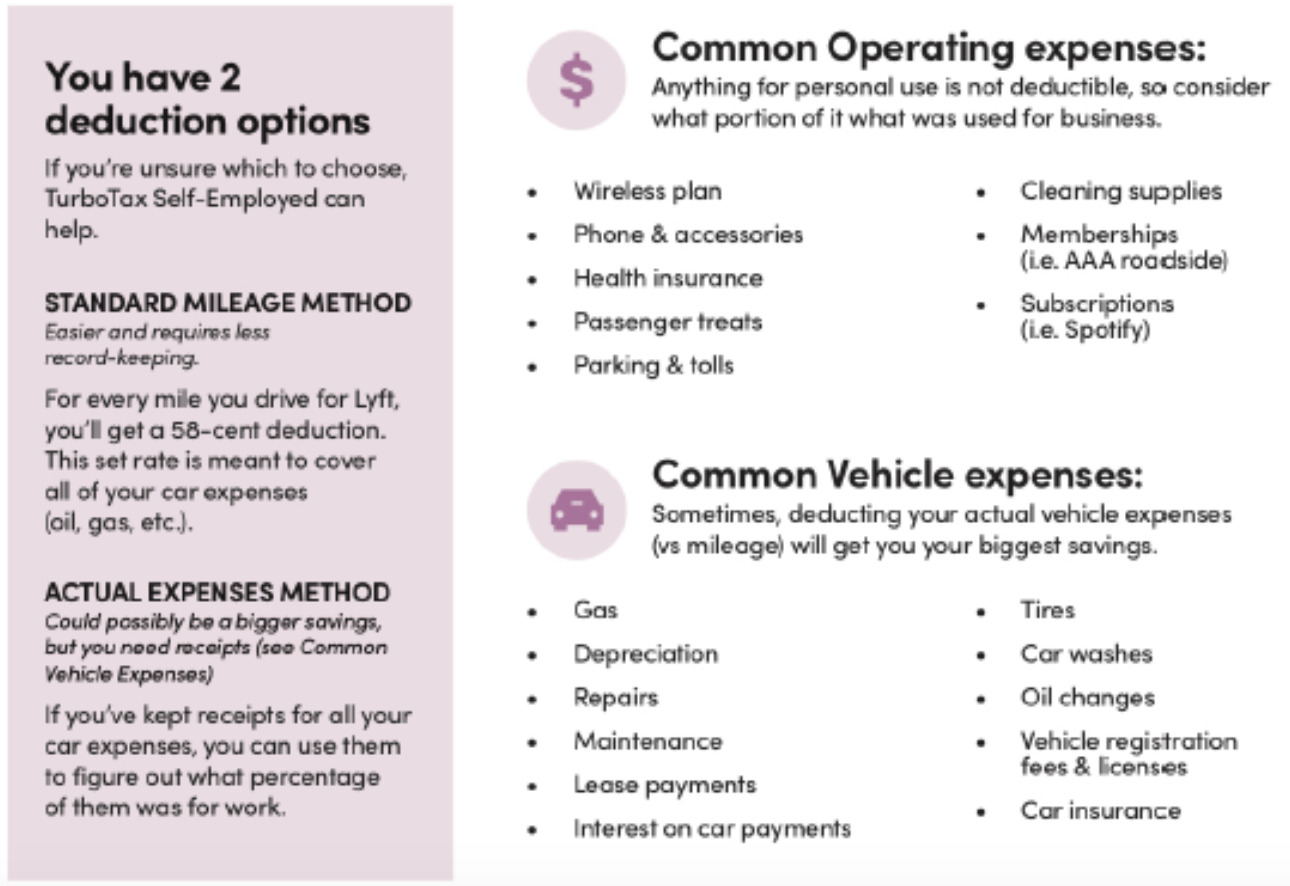

They also include any fee you paid for electronic filing of. Average Tax Preparation Fees. Only the self-employed can claim a deduction for tax preparation fees in tax years 2018 through 2025 if Congress does not renew legislation from the TCJA.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Credits can reduce the amount of tax you owe or increase your tax refund and some credits may give you a refund. Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be deducted.

The cost of your tax preparation fees is deducted like a business expense deduction. For most Canadian taxpayers the answer unfortunately is no. According to a National Society of Accountants survey in 2020 on average you would have paid 323 if you itemized your deductions on your tax return.

I recently saw a tax return for 2020 that showed the tax return deduction. How Credits and Deductions Work. Since 112018 tax return prep fees.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. It was obvious the preparer wasnt sure where to put it on Schedule A Itemized Deductions and so he had put it on the wrong line and attempted to override the program. However the big question is how do you write off your tax preparation fees.

November 2020 11 Combined Excise Tax Return Deduction Detail 20 If you have deductions return pages 3 and 4If you do not have deductions do not return pages 3 and 4. When you claim federal tax credits and deductions on your tax return you can change the amount of tax you owe. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes.

This means that if you own a business as a sole proprietor you are eligible for this deduction and can claim it. That year you paid 80 in investment interest expenses and had investment income of 160. If you take the standard deduction on your 2020 tax return you can deduct up to 300 for cash donations to charity you made during the year.

For a breakdown on the average cost of filing common forms check out the following from the National Society of Accountants. These fees include the cost of tax preparation software programs and tax publications. Can you deduct tax preparation fees in 2020.

We cannot approve deductions taken on the Combined Excise Tax Return that are not itemized on pages. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state income tax return was a flat. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners.

Is Social Security taxed after age 70. Washington State Department of Revenue PO Box 47464 Olympia WA 98504-7464 MAIL TO. I recently saw a tax return for 2020 that showed the tax return deduction.

Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. For 2020 joint returns the amount allowed is still only 300 Donations to donor advised funds and certain organizations that support charities are not deductible.

MINIMUM CHARGES FOR TAX PREPARATION Minimum Per Return Federal 1 State 650 1040 with Business Return Schedule C SE 750 Partnership Returns 1750 Corporation Fiduciary Returns 1750 Bookkeeping or record reconstruction for Tax Preparation during the months of January thru April per hour 260. Prior to 2018 taxpayers who werent self-employed were allowed to claim. Like most legal questions the answer to this question begins with it depends Tax Deductible Legal Expenses.

Form 1040 non-itemized with state return. If you take the standard deduction you will not be able to deduct any portion of your personal tax preparation fees however you will still be able to deduct the full cost of your business. February 27 2020 1 Min Read.

To illustrate lets say that in 2020 you took out a 2000 personal loan with an interest rate of 4 to purchase an investment you expect to generate an 8 return. If youre looking for some extra tax relief you may be wondering if the cost of preparing your tax return is deductible. A sole proprietor or independent contractor who files a schedule C with your return.

Self-employed taxpayers can still write off their tax prep fees as a business expense. You would be able to deduct the full 80 of investment interest if you itemize. Who Can Still Deduct Tax Preparation Fees.

IRS Publication 529 dictates which expenses can be itemized as miscellaneous deductions for the purpose of tax returns. The Tax Cuts and Jobs Act lowered. Deducting Tax Preparation Fees as a Business Expense.

You can deduct the full cost of your business tax preparation fees on your Schedule C and a portion of your personal tax preparation costs on your Schedule A subject to limitation. According to the IRS legal fees for estate tax planning services may be tax deductible if they are incurred for one of the following purposes. Get Your Max Refund Today.

Form 1040 with Schedule A and state return. The fee is usually a flat rate that applies to each schedule or form. This means that if you are self-employed you can deduct your tax preparation fees under your business expenses at least through the year 2025 if Congress.

On the other hand individuals who are self-employed are able to deduct the cost of the tax preparation fees including tax software or working with a professional. However you can deduct some of the cost and other expenses from your gross income to lower your tax bill. Accounting fees and the cost of tax prep software are only tax-deductible in a few situations.

Business Bookkeeping Tracking Your Expenses And Income In 2021 Business Tax Deductions Tax Deductions Small Business Tax

Small Business Tax Deductions For 2022 Llc S Corp Write Offs

The Master List Of Small Business Tax Write Offs For 2020 Owllytics Small Business Tax Business Tax Business Tax Deductions

Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Business Expense

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

What Items To Keep Track Of Deductions Sheets For Your Home Based Business Business Tax Deductions Small Business Tax Business Expense

Vehicle Sales Tax Deduction H R Block

2020 Tax Deduction Amounts And More Heather

Tuition And Fees Deduction H R Block

The Ultimate List Of Tax Deductions For Online Sellers Tax Deductions Small Business Tax Deductions Small Business Tax

Tax Preparation Checklist Tax 2021 Mbafas

Income Tax Deductions Fy 2019 2020 Tax Deductions List Income Tax Income Tax Preparation

Difference Between Standard Deduction And Itemized Deduction H R Block

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Tools For Filing Taxes Tax Software Turbotax Tax Refund

2021 2022 Tax Brackets Rates For Each Income Level