haven't paid taxes in years uk

Up to 20 cash back Accountant. Im now really concerned that Im going to be charged for something that has be an admin mistake more than anything else.

You need to see an accountant who does personal tax and get help sorting this out as you need someone used to dealing with HMRC when they are being difficult over old.

. Note carefully however that because you did not pay tax on time you will be charged penalties and interest which could be significant sums of money by the time you tot up 4 years worth. Not filing taxes for several years could have serious repercussions. As part of the UKs 202021 tax year 6th April 2020 to 5th April 2021 dividend allowance is 2000 per year.

This means that if they become aware of an underpayment. I have no savings to pay for. Freelancing in the UK for a few years havent filed tax return but now live abroad.

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Generally HMRC will only accept three years of late tax returns although sometimes they may let you. Add interest on your balances.

After May 17th you will lose the 2018 refund as the statute of limitations prevents refunds after three years. 8k living off savings barely earning enough to heat the house and I didnt file a tax return because I couldnt have afforded to pay it. What money i earned went on family - Answered by a verified UK Tax Professional We use cookies to give you the best possible experience on our website.

I have been self-employed for about 7 years and have not paid any tax on my earnings im not to sure what i have to do. Tax not paid in full by the original due date of the return regardless of extensions of time to file may also result in the failure-to-pay penalty unless you have reasonable cause for your failure to pay timely or the IRS has approved your application Form 1127 Application for Extension of Time for Payment of Tax Due to Undue Hardship. If youve not done a tax return for a long time whether thats three years five years ten or even twenty years all is not lost.

The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a. The most important thing to do is to sort it out quickly and let HMRC know that its under way. Freelancing in the UK for a few years havent filed tax return but now live abroad.

I have been self-employed for about 7 years and have not paid. Lets start with the worst-case scenario. I havent been earning any money elsewhere and have been pay taxes via my full time PAYE job for the past 5 years.

HMRC operate dynamic coding practices too. Theyre sending the returns through to me and have asked me to fill in all 5. You should file your returns for both tax years to make sure the IRS doesnt get to keep your tax refund check.

Ive been self-employed for ten years since being made redundant in 2002 - in the first 2 years I was earning cz. The clock is ticking on your chance to claim your refund. Havent Filed Taxes in 2 Years If You Are Due a Refund.

First get your records together ie income expenditure etc. First and foremost dont panic. The IRS offers short-term 120 days or.

Youll need to fill in a separate tax return. Late filing penalty 5 of unpaid balance for each month or part of a month that the return is late up to a maximum 25. It depends on your situation.

For each return that is more than 60 days past its due date they will assess a 135 minimum failure to file penalty. If you know that you have not paid UK taxes in years the scary part is that HMRC can charge substantial penalties. Before you panic lets take a look at what could actually happen and how you can mitigate the chances of the worst.

However using a qualified tax adviser gives you that impartial review to let you know exactly how big a problem you really have followed by a strategy to approach HMRC with your tax figures and minimise their likelihood of excessive charges. Up to 20 cash back I havent paid tax and ni for nearly 20 years been a self empoyed plumber. Every year for the past 10 years 500000 people who werent born in the UK and havent paid taxes signed up with a UK GP.

Write to HMRC advising you had casual income in the tax years state what they are as shown in the schedule and ask if you need to complete a tax return. Go and see tax advisor or accountant. Our verdict About 650000 people a year of whom most are probably immigrants sign up with GPs in England and Wales.

Havent paid tax in 5 years - need advice please. Make full disclosure and put everything in order. Late payment penalty 05 the unpaid balance for each month or part of a month up to a maximum of 025.

The accountant also should be able to advise. Things got slightly better the next couple of years but I then had the fear of the back-taxes and still unable to pay to stop me. The tax will begin as a 125 rise in National Insurance from April 2022 and will be a separate tax on earned income from 2023.

If you do not usually send a tax return you can register for Self Assessment to declare any income you have not paid tax on from the last 4 years. 29 Dec 2020. The tax return for each year will need to be filed separately.

Posted by 6 years ago. Create a template for future compliance. Postby RAL Sun Apr 25 2010 1038 pm.

If you owed taxes for the years you havent filed the IRS has not forgotten. Rate fluctuates between 4 and 8 throughout. HMRC will usually try to collect the underpayment in one tax year but if your P800 was issued late in the tax year they may spread collection over more than one tax year.

No matter where the income is from whether its from abroad or the UK all residents pay UK tax. There will be some penalty interest and tax payable. 2 days agoAs non-residents of the UK they solely pay tax on their UK income whereas those of foreign origin dont pay UK tax.

Not only can the IRS stop you from applying for a passport or a mortgage but they can also create a S ubstitute for Return against you charge you for failure to pay or charge you for failure to file. If the IRS thinks you may owe for these tax years you may have received one or more notices from the IRS by now. Details of how the amount is to be collected should be shown on the form.

Self-assessment is a way of declaring all income you have paid no tax on for over four years if you dont usually file a tax return. Once the returns for each year youve been delinquent are filed pay off your back taxes and penalties. If HMRC decide you should have completed a tax return then they would issue you with a Unique Tax reference number UTR it is ten digit reference number if you dont already have one and also advise for which years you.

Under the social care plans no-one will have to pay more than 86000 for care across their lifetime while anyone with. 2 days agoWhat Do I Do If I HavenT Paid My Taxes In Years Uk.

Paying Tax On Cd Interest Bankrate

Is Not Paying Tax A Crime Uk Ictsd Org

Tax Return Deadline 2022 When Is The Online Tax Return Deadline Marca

How To File Your Uk Taxes When You Live Abroad Expatica

How A Derelict Old Gin Distillery Became A Family Home Home House Interior Interior Architecture Design

Mega Backdoor Roth Financial Independence Roth Finance

I Haven T Paid Income Taxes Since 1994 And The Irs Won T Send Me To Prison Income Tax Irs Stolen Identity

Ebitda Accounting And Finance Financial Strategies Financial Management

Dubsado Vs Honeybook Why I Switched To Honeybook 2020 Review In 2021 Honeybook Freelance Freelance Writer

How Nannies Should Report Extra Babysitting Income Nanny Tax Income Tax Help

How Fortune 500 Companies Avoid Paying Income Tax

Home Office Customizable Vinyl Sticker Zazzle Com In 2022 Sticker Labels Preprinted Labels Labels

Https Www Paydayloansnowdirect Co Uk Direct Lenders Direct Loan Lenders All The Lenders Uk Html Loan Direct Lender Loan Lenders Cash Loans The Borrowers

Why Keep Personal And Business Expenses Separate The Sensible Business Owner Business Expense Tax Time Small Business Bookkeeping

Tax Estimation Budgeting Make Easy Money Budgeting Money

Uk Tax Authorities Pay Record 605 000 To Informants Hmrc The Guardian

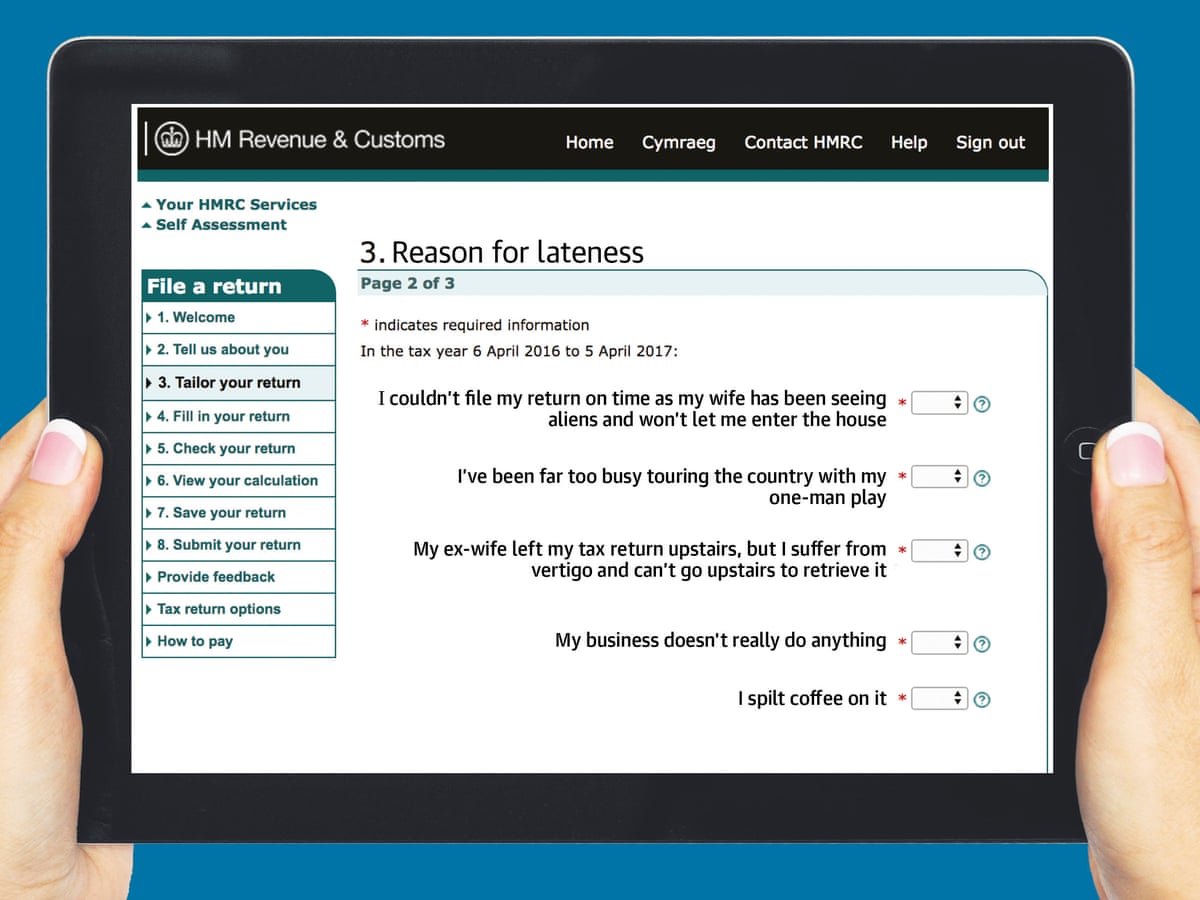

Uk Tax Returns Here S How To Tackle Yours Now Income Tax The Guardian

Nエkkエ Blm On Twitter Flamingo Art Albert Flamingo Flamingo Albert